January 2023 - Ottawa Monthly Market Newsletter

Local News:

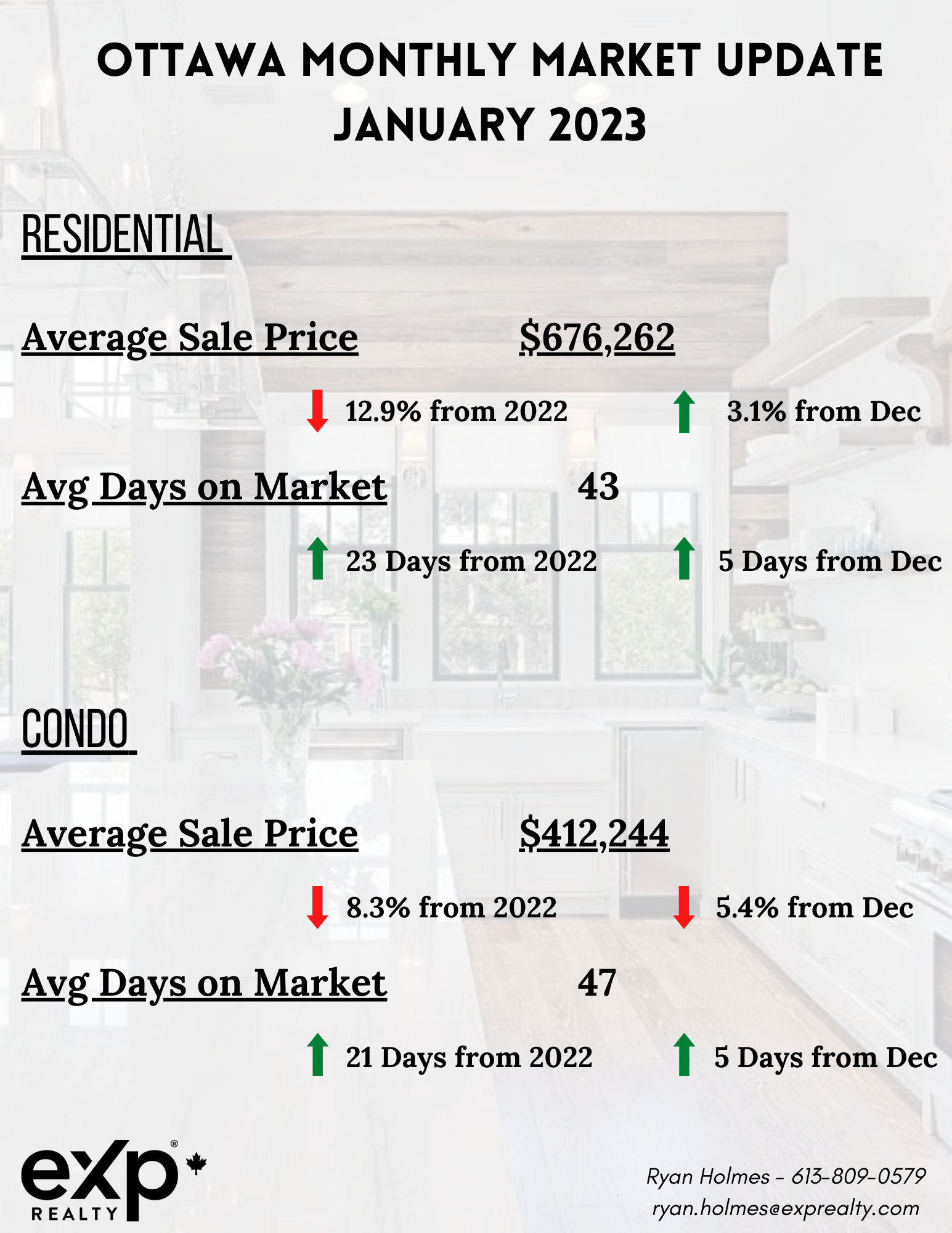

January was a bounce-back month for Residential properties, moving 3.1% higher from December prices to $676,262. However, average prices (which can fluctuate violently and over-exaggerate price movements up or down) have dropped 12.9% from January 2022. Days on market continues to climb, up 5 days from December and 23 days when compared to January 2022.

Condo prices were more stable during the past few months but dropped 5.4% over the last month, now down 8.3% from January 2022.

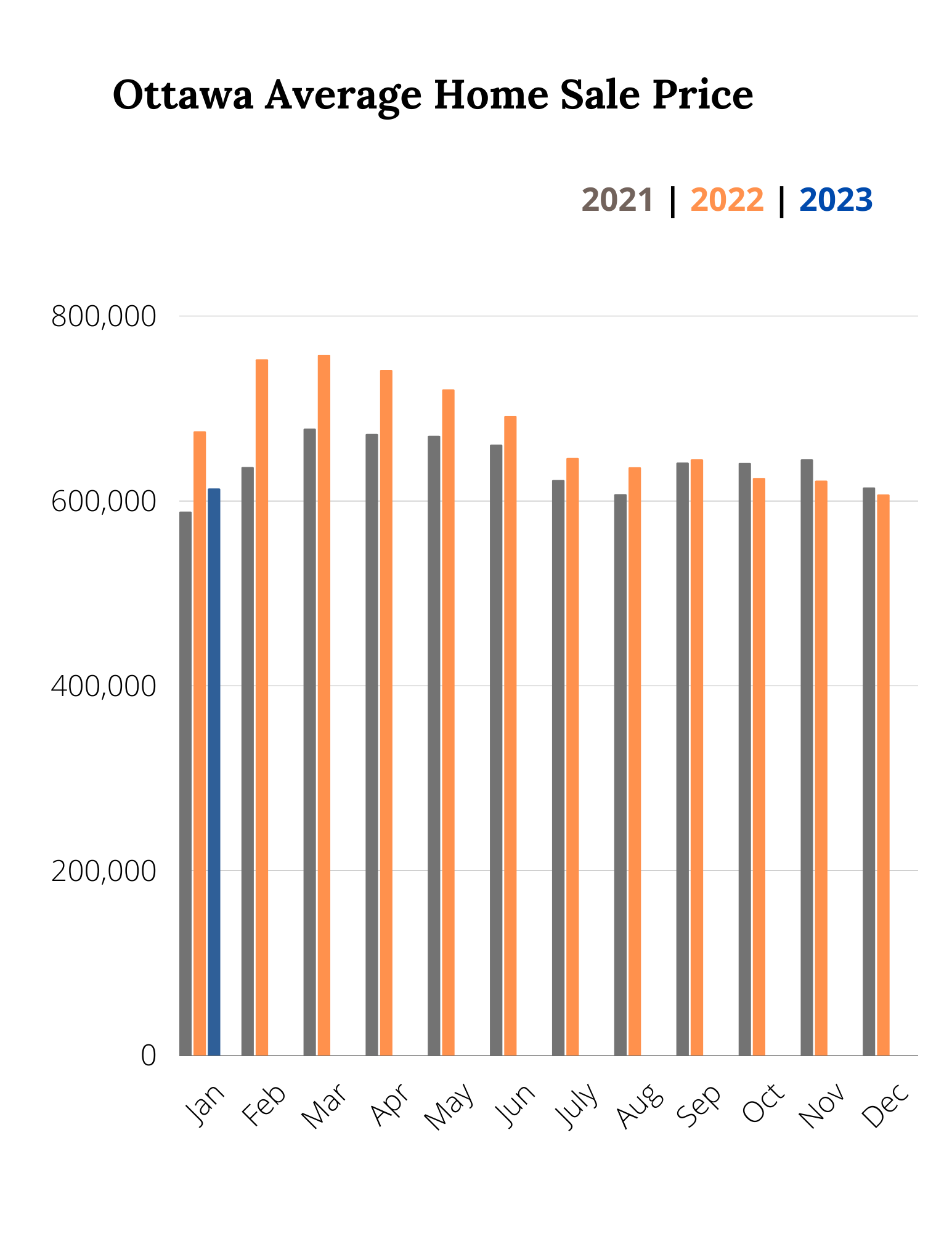

Homeowners may feel some comfort in the fact that while prices have dropped, they’re still well above pre-covid levels (Jan 2020).

Average Res/Condo Price, January 2021 - 2023

| 2020 | 2021 | 2022 | 2023 |

|---|---|---|---|

| $465,524 | $587,791 | $674,562 | $612,661 |

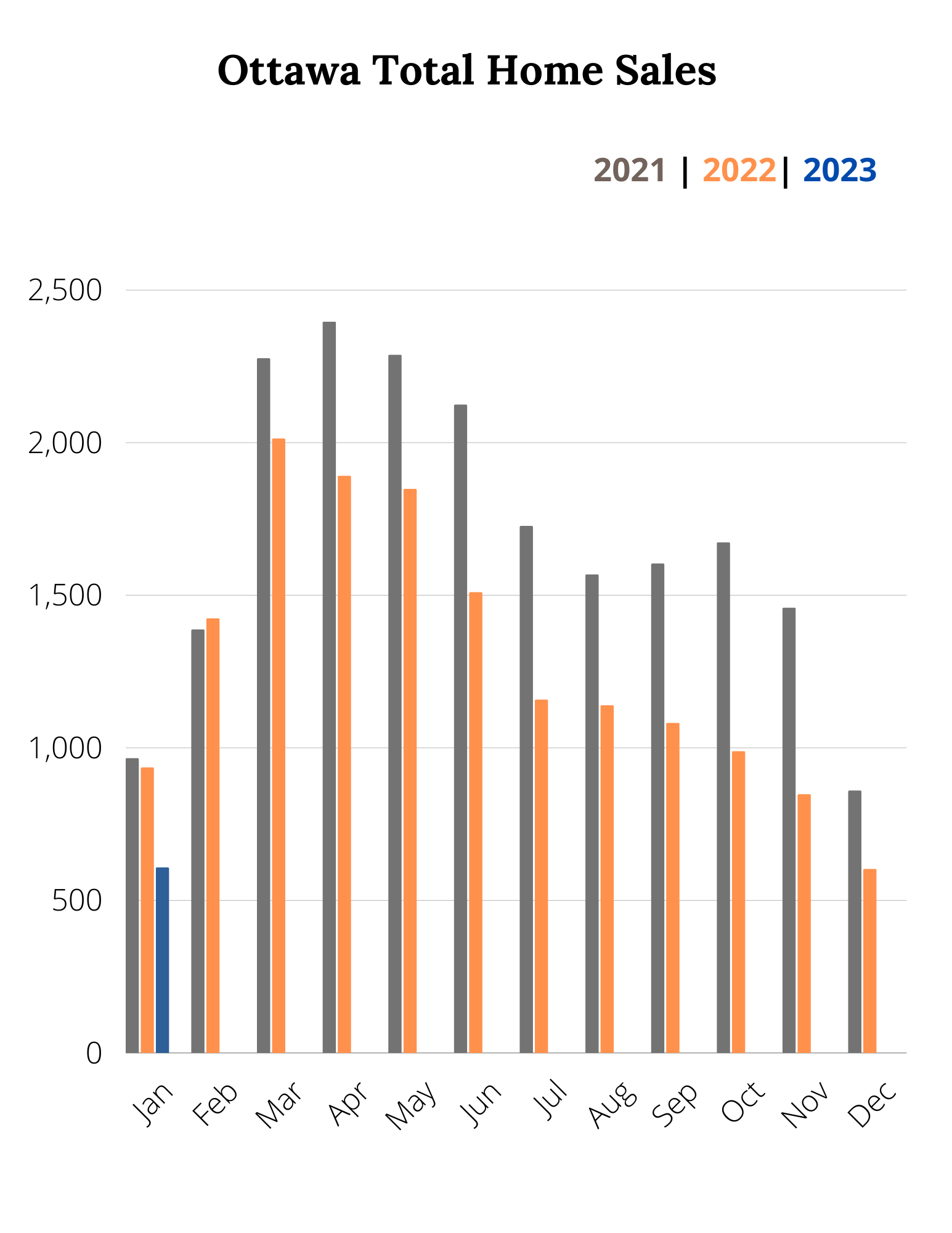

Sales on the other hand are well below the covid and pre-covid levels. Sales activity may be suppressed due to a number of factors:

- Penny pinching due to current/incoming recession

- Elevated rates / decreased affordability / no longer qualify

- Waiting to see what happens / unsure about the market / trying to wait for the bottom

- Less speculation, home flipping, investors, etc

- Foreign buyer ban

- Many would-be homeowners purchased during the pandemic

Macro News:

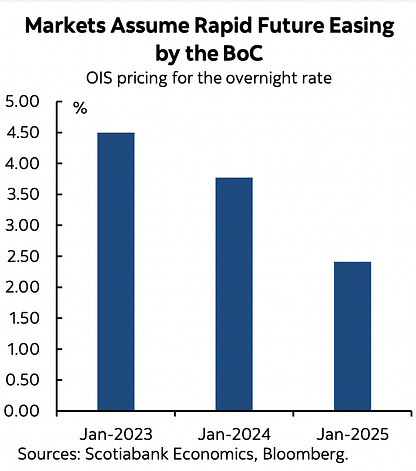

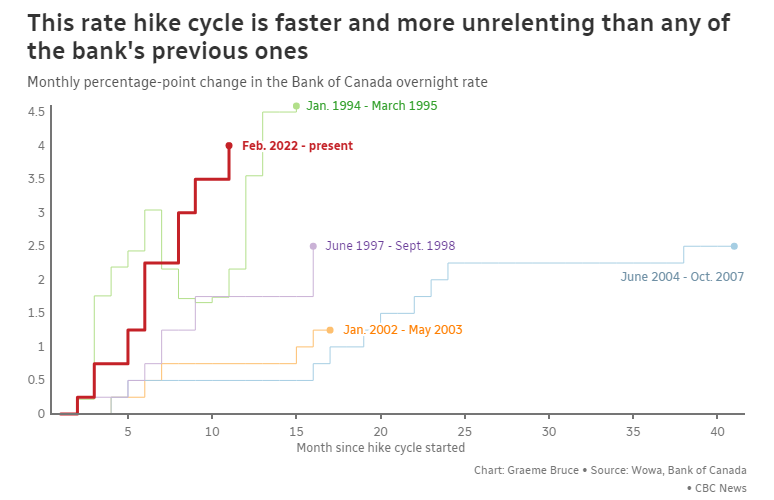

The Bank of Canada raised rates once again, this time opting to raise by 0.25% - the overnight rate now sits at 4.5%. The BoC hinted that rates may have peaked for the time being, “With today's modest increase, we expect to pause rate hikes while we assess the impacts. To be clear, this is a conditional pause. Its conditional on economic developments evolving broadly inline with our outlook.”.

Variable rate mortgages are sitting at 6%, up nearly 500bps from last year. According to National Bank, between 73% to 80% of variable-rate fixed payment mortgages originated between 2020 and 2022 have been triggered during this tightening campaign. Variable rate mortgages account for nearly 35% of the total float of mortgage debt in this country.

Inflation has begun to scale back coming in at 6.30% which is down from it’s June peak of 8.1%. As we approach the high inflation hurdles that began in March ‘22, we should see a rapid year-over-year improvement which should create rate stability and subsequent rate decreases in late 2023 / early 2024.

The most recent rate announcement will impact Variable rate mortgages as follows:

- For every $100K on your Variable rate mortgage, your payment will increase by approximately $16.22/m.

- Ex: If your mortgage balance is $435,000, your payment will go up by approximately $70.56/m

- Variable mortgages are currently premium priced compared to their Fixed counterparts by approximately 100bps (1.00%).

- Variable rates are expected to start going down within the next year so those looking at a 5-Yr term should consider a short-term Fixed between 1-3 years. This will ensure that they are not locked in at a high rate when market conditions improve.

Since peaking in March 2022, the National Home Price index is now down a whopping 17%, the largest decline on record by a country mile.

- Rate Cuts are priced into the Bond Market

- 2022 - The most aggressive rate hike cycle

Categories

Recent Posts

.jpg)

GET MORE INFORMATION